Class A Multifamily Investment in Greenwich, CT

Projected Returns

2.0x

Equity Multiple

25%

IRR

25%

AAR

Unique Off-Market Stabilized Multifamily Package Acquisition

We found two gems in a market where most potential multifamily investments just don’t stack up! The Redwood team is excited to present a rare opportunity to invest in two A-Class multifamily assets in unbeatable locations.

168 N Water Street and 15 Beech Street, located in coveted Greenwich, CT, represent an opportunity to acquire “off-market” owner-direct multifamily investments. It’s a rare special situation in which multifamily properties delivers outstanding returns despite the interest rate environment.

We are acquiring premium assets below market value.

Projected Returns

25%

IRR

25-37%

AAR

2-2.5x

EM

The Properties:

- Purchase Price:

- $4,400,000 ($400k per unit)

- 11 Unit Mix:

- 10 2BD/1BA

- One (1) 4BD/2BA

Most Recent Comparable Sale: Latest transaction sold for 650k per unit (3-unit at 180 N Water St in Sep-23).

Mispriced

Off-Market

Owner-Direct Purchase

Turnkey Renovation

Supply Demand Imbalance

Fully Leased Day 1

- Beech: Average of $2,650 per unit

- N Water Street: Average of $3,200 per unit

Early Cashout Within 18 Months

We expect to return 30% of the initial equity investment within the first 18 months post-close.

Once we increase the property’s NOI through efficient management, we can access an additional $670k in debt through an earn out provision.

Benefits of an earn-out over a refinance:

- NO prepayment penalty fee.

- NO refinance fee.

- More funds delivered to the investor.

- Fixed Rate: ~7%

- 5-year term, 30-year amortization schedule.

- Interest-free months for 6 months.

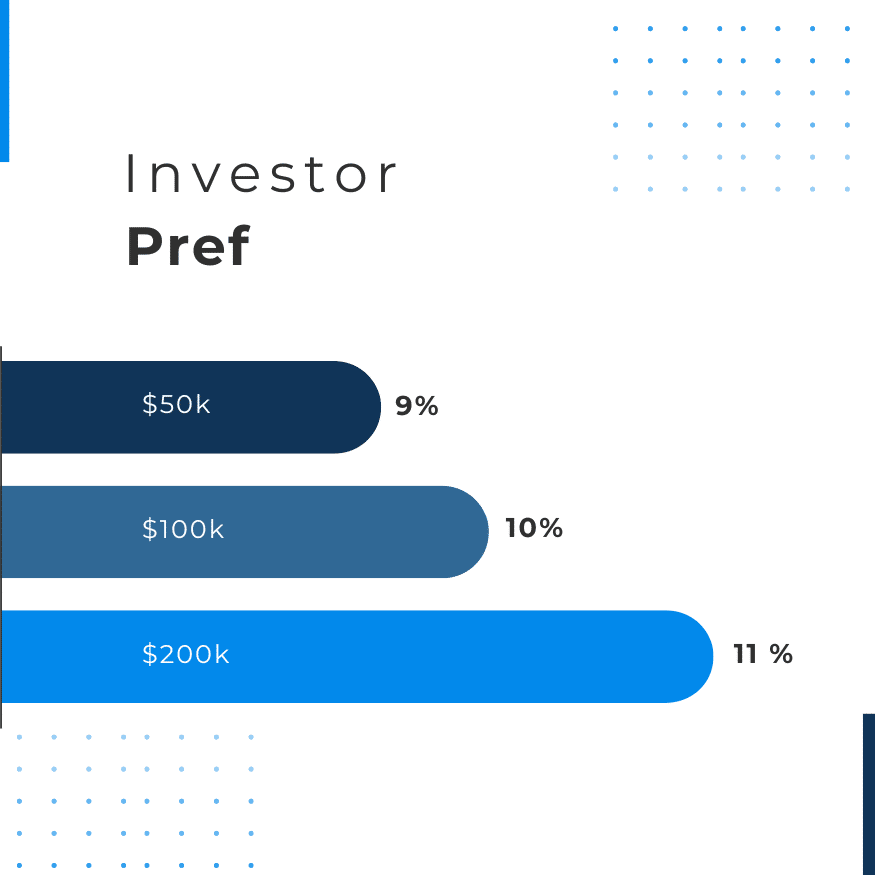

Invest More, Get a Higher Prefered Return

Our minimum preferred return is 9% and increases incrementally by investment amount.

What's a Preferred Return?

A preferred return in a real estate syndication is a prioritized return on investment that investors receive before the general partners or sponsors receive any profit distributions.

5 Powerful Reasons to Invest in the Greenwich Multifamily Package

Highly Discounted Price!

We are buying at a ~55% discount compared to the most recent comparable, with ~7% cap rate, a very high cap rate in multifamily.

Optimal Loan Terms

5-year loan, six months interest-free, and a built-in cash-out condition.

Low Inventory Market

There is very little rental inventory at this price point in Greenwich, therefore low vacancy rate.

Cash Flow Day 1

In our contract, the properties must be delivered fully occupied, producing higher natural cash flow than typical MF deals.

Value-Add Optionality

The potential for a basement fitness center provides the opportunity to increase returns but isn’t necessary for investment success.

5 Powerful Reasons to Invest in the Greenwich Multifamily Package

Highly Discounted Price!

We are buying at a ~55% discount compared to the most recent comparable, with ~7% cap rate, a very high cap rate in multifamily.

Optimal Loan Terms

5-year loan, six months interest-free, and a built-in cash-out condition.

Low Inventory Market

There is very little rental inventory at this price point in Greenwich, therefore low vacancy rate.

Cash Flow Day 1

In our contract, the properties must be delivered fully occupied, producing higher natural cash flow than typical MF deals.

Value-Add Optionality

The potential for a basement fitness center provides the opportunity to increase returns but isn’t necessary for investment success.

Favorable Risk-Reward Investing with NO SPECULATION

Our Greenwich Multifamily Package will be delivered fully leased in a suburb with an extreme supply demand imbalance. This will enable rent increases of 5-7% annually.

High-End Fully Renovated Units

The buildings have had extensive renovations ($80,000/unit) with custom finishes designed to attract high-quality tenants. Tenants of A Class buildings who love their spaces extend their leases and maintain the property, ultimately reducing vacancy, maintenance, and property management costs.

- Six 2 bedroom, 1-bathroom 850 sq. ft + units.

- Four 2 bedroom, 1-bathroom 750 sq. ft + units.

- One 4 bedroom, two bathroom 1,400 sq. ft + unit.

- Open floor plan.

- New kitchens & bathrooms.

- Engineered hardwood floors.

- Modern lighting.

- Quartz countertops.

- Stainless appliances.

- In-unit laundry.

- New security system.

- Shared grilling area.

Investment returns are not contingent on market conditions (zero speculation) but the result of an exceptional deal and opportunity.

These multifamily properties might be our most secure investment to date.

❝ The professional acumen and market insight demonstrated by Ben Spiegel and the Redwood team throughout this venture are commendable, exemplifying a results-driven approach that inspires confidence. ❞

Matt Cawley

President of National Multifamily

Why We Love Greenwich

Greenwich, CT, is a well-known affluent and upscale suburb that attracts residents due to its commuting proximity to Manhattan.

Average Home Price

$1,928,404 (+6.8% YoY)

Average Rent 2 Bed Unit

$5,582 (+7% YoY)

Median Household Income

$127,123

The subject investment is located in the neighborhood of Byram, bordered by Long Island Sound and the Byram River. This lovely area is located in the southwest corner of Greenwich on the New York border.

Investors get a stabilized asset in a high-end end suburb that has incredibly strong rental demand. Greenwich has proven year after year that it’s an incredible area to be a landlord.

#1 Reason Greenwich is a Fantastic Market for Multifamily Investing:

NO Rent Control & 5-7% Rent Increase Upon Renewal

❝ The transparency from Redwood Capital is unparalleled. Their monthly investor updates keep me well-informed about my investments and the market, fostering a level of trust and engagement I haven’t experienced with other firms. This open communication is a cornerstone of their service and greatly appreciated. ❞

Ted Koly

Financial Advisor - Portfolio Manager, Morgan Stanley

Business Plan

We are acquiring the properties at below-market value with secured rents also below market value, offering a minimum growth potential of 20%*.

Year 1 projected NOI is about $300,000, which we expect to increase to about $400,000 by Year 3.

- Storage

- Parking

- Common space

- Potential gym

Exit Cap Rate: 6% *

Our Value-Add Transformation Strategy

While no work needs to be done to this property (all existing units are renovated) to deliver outperforming investor returns, that is not enough for us or our investors.

An opportunity presents itself in the unfinished basement to add a large 7th unit for approximately $140k.

As a result, we expect:

- Increased Gross Rent: $50,400

- Increased Property Value: $450k

- 3x Return on Invested Capital

Should we not get approved for the additional unit (which we see as unlikely), we have decided to put a backup plan in place. If we cannot add the 7th unit to the basement, we plan to build a gym with Pelotons, a sauna, and high-end gym equipment to increase tenant rent.

How Did We Find Such An Incredible Deal?

The current owner is an “absentee” seller who lives out of state. They have an extensive real estate portfolio (~3,000 units across the county), effectively making this property relatively minuscule in importance.

As the seller is unfamiliar with this area, they engaged a local residential broker to manage the renovations and lease-ups. The broker has spent the past eight months gut-renovating all six units with an average CapEx spend of ~$80K/unit.

This high level of renovation is extremely rare and is usually reserved for condo buildings.

We our incredibly favorable deal terms are a direct result of the following:

- A motivated seller.

- The value of these buildings compared to his other holdings is de minimis.

- Seller’s low-cost basis, so they are still making a profit and cashing out.

Property Management

- Strategic Renovations & Upgrades

- Budgets

- Tenant Screening & Selection

- Market Lease Optimization.

Incredible Financing Terms

We are leveraging our longstanding relationship with the First Bank of Greenwich (FBG) to secure a 70% LTV loan of $1,715,000. The 5-year loan will bear a market interest rate of approximately 7% but contains favorable terms, including:

- Six months of interest-only payments

- 30-year amortization schedule

- A standard prepayment penalty structure of 5-4-3-2-1

The loan is unique as it includes an 18-month earnout provision that allows for an additional debt of up to $535,000. This means that up to 55% of investors’ original cash equity contribution can be returned as a distribution upon this payout. The maximum total debt of $2.25M is based on maintaining a 70% LTV and a 1.20x debt service coverage ratio (DSCR) based on an updated, post-renovation appraisal and in-place cash flow. This implies that the bank believes the building could be reappraised at approximately $3,200,000, representing a 31% capital appreciation within the first 18 months post-close.

Why Now is a Good Time to Buy A-Class Multifamily

If you pay attention to us on social media, you might have noticed that we have strategically focussed on asset classes outside the multifamily sector. But as special situation investors who are not biased to asset classes, we will not turn down an UNBELIEVABLE OPPORTUNITY when it’s literally on our doorstep.

Not only is N Water Street a phenomenal deal because we are buying at a massive discount, but market conditions indicate that now is a great time to buy the right kind of multifamily.

Rates Will Fall

Interest rates have peaked and are on their way down throughout 2024 and 2025.

The U.S. Economy is Strong

Our economy has avoided a recession and is doing incredibly well. The FED has orchestrated a soft landing, and wage growth has finally surpassed inflation.

Rent vs Buy

The monthly purchase cost to own now exceeds rent by a whopping 50%. For most people, it is better to rent than to buy a home. This is especially true in expensive regions like NYC.

❝ As the Founder & President of Brahman Capital, a multi-billion dollar long short public equity hedge fund with a 30-year track record, it is very difficult to find the time to analyze middle market private investment opportunities. RCA has been my go-to for off-the-run special situations since 2017. ❞

Mitch Kuflik

Founder of Brahman Capital

Another Building on the Horizon

Lastly, we are excited to announce we are days away from having an executed LOI on a 5-unit multifamily building from the same seller of 168 N Water located at 15 Beech Street for $1.9M ($380K/unit) and >7% in place cap rate. It will also be acquired while extensive renovations are underway, and closing will be contingent on an attractive in-place rent roll. We plan to eventually sell both buildings as a package, boosting their valuation.

Our team is also actively pursuing other owner-direct off-market special situation acquisitions in this area of Greenwich to further boost our economies of scale and continue to offer our investors access to special situation off-market deals with above-average risk-adjusted returns and abnormally quick returns of large portions of initially invested capital.

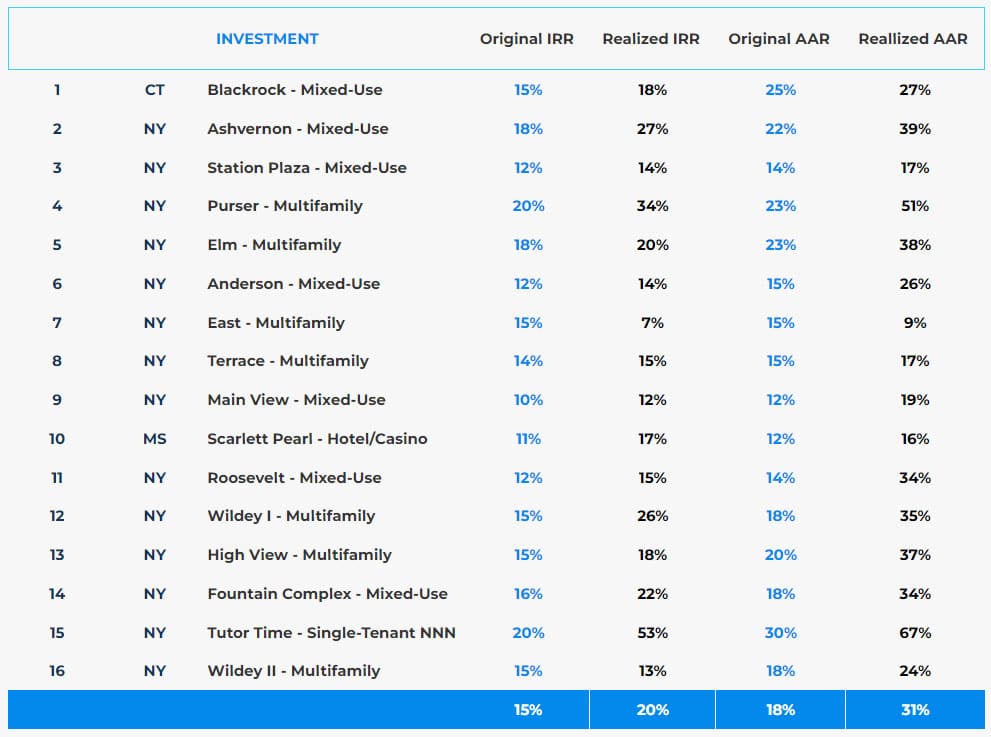

Our Track Record

| INVESTMENT | Original IRR | Realized IRR | Original AAR | Reallized AAR | ||

|---|---|---|---|---|---|---|

| 1 | CT | Blackrock - Mixed-Use | 15% | 18% | 25% | 27% |

| 2 | NY | Ashvernon - Mixed-Use | 18% | 27% | 22% | 39% |

| 3 | NY | Station Plaza - Mixed-Use | 12% | 14% | 14% | 17% |

| 4 | NY | Purser - Multifamily | 20% | 34% | 23% | 51% |

| 5 | NY | Elm - Multifamily | 18% | 20% | 23% | 38% |

| 6 | NY | Anderson - Mixed-Use | 12% | 14% | 15% | 26% |

| 7 | NY | East - Multifamily | 15% | 7% | 15% | 9% |

| 8 | NY | Terrace - Multifamily | 14% | 15% | 15% | 17% |

| 9 | NY | Main View - Mixed-Use | 10% | 12% | 12% | 19% |

| 10 | MS | Scarlett Pearl - Hotel/Casino | 11% | 17% | 12% | 16% |

| 11 | NY | Roosevelt - Mixed-Use | 12% | 15% | 14% | 34% |

| 12 | NY | Wildey I - Multifamily | 15% | 26% | 18% | 35% |

| 13 | NY | High View - Multifamily | 15% | 18% | 20% | 37% |

| 14 | NY | Fountain Complex - Mixed-Use | 16% | 22% | 18% | 34% |

| 15 | NY | Tutor Time - Single-Tenant NNN | 20% | 53% | 30% | 67% |

| 16 | NY | Wildey II - Multifamily | 15% | 13% | 18% | 24% |

| 15% | 20% | 18% | 31% |

Redwood Track Record:

Exits Exceed Projections

( Average Hold: 3 yrs )

Stay In Touch

Not ready to invest?

Join our newsletter to stay informed about upcoming investment opportunities.